For the FMCG world, two strong macro factors are influencing the demand right now in India. One is inflation and the other is the incredibly hot summer the country is going through. But while looking at the demand and offtake data for drawing YoY comparisons, we should consider the impact of Covid’s second wave last year which resulted in a drastic reduction in demand for a few categories.

The personal care segment (Deo, toiletries, Grooming Products, Hair Care, Oral Care Personal Hygiene, and Skin Care) is one such segment. While it normally goes through a cycle of de-growth in the summer season it has seen considerable YoY growth and has not seen a slowdown in premium brands due to inflation.

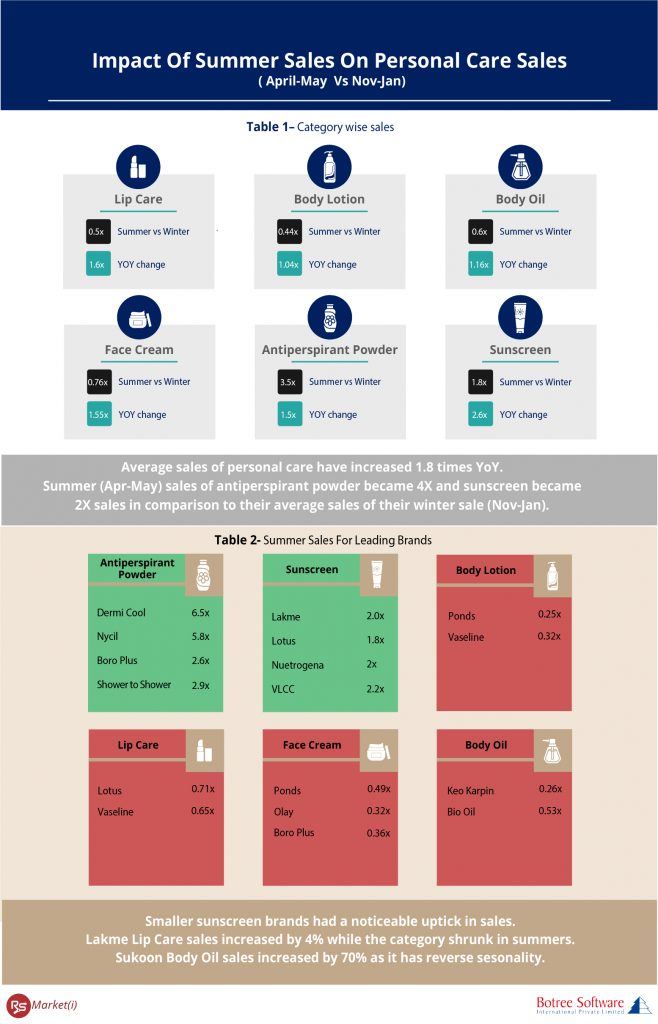

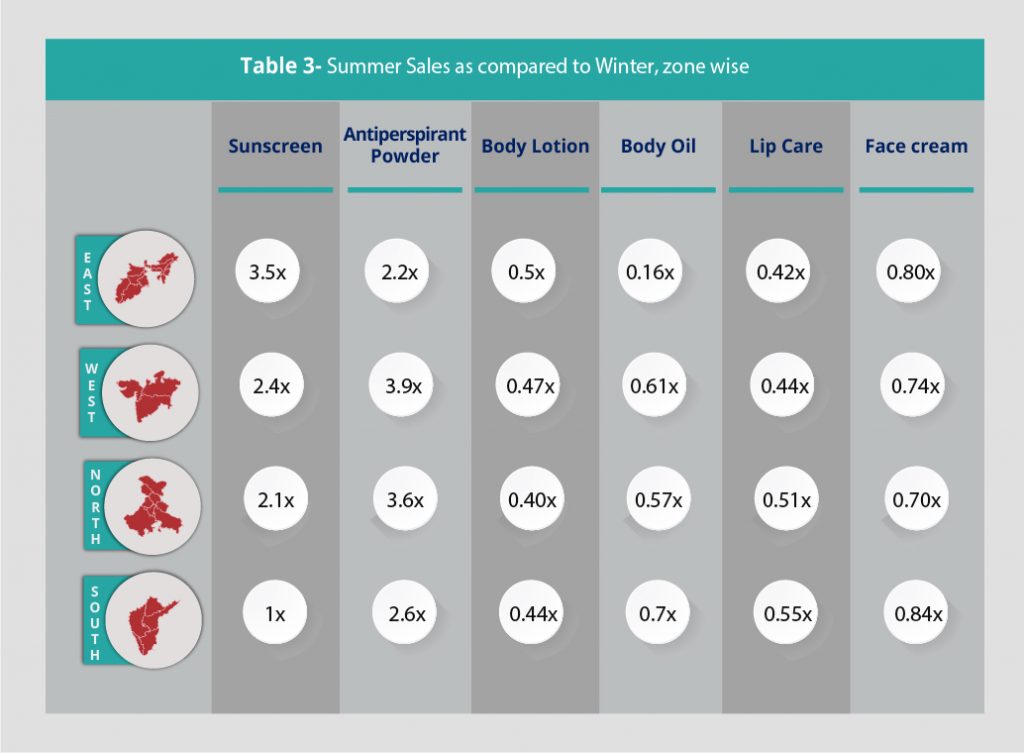

While the average sales in the summer months (April, May) is three fourth of the average sales in the winter months (November, December, and January), the sales have increased to 1.8 times last year’s summer sales. Sunscreen and antiperspirant powder categories, in particular, have seen the highest seasonal growth across the country as compared to Lip Care, Body Lotion, Body Oil, and Face Cream which have seen a drop in sales. But if we keep seasonality aside, all these categories have seen a YoY growth.

While the growth in antiperspirant powder can be attributed to the season, growth in sunscreen is singular. People are stepping out more this year in the summer than in the Covid period last year when the second wave was at its peak. This can also be seen in the YoY growth of Face Cream and Lip Care and the drop in sales of sanitisers.

If we get a little particular and start analyzing the trends within the categories, we saw interesting patterns emerging at the brand level. While we found that Dermi Cool is the smash hit brand in the antiperspirant category, Lakme sunscreen saw the maximum growth in the sunscreen segment.

In categories that saw a seasonal dip, we found that Lakme Lip Care has maintained its sales in the summer months as well, while the other top brands in the category have seen a decrease in sales. Similarly, for the Body Lotion segment, the top 10 brands saw a considerable dip in sales (.5x), but Mama Earth (1.03x), Dabur (1.02x), and Lotus (1.2x) remain unaffected. Interestingly, in the body oil segment, Sukoon sales have increased to 1.6 times but then unlike other body oil brands, it has a reverse seasonality impact with larger demand in summers.

If we look at Face Cream, 73% of sales were seen from mass brands last year in April and May. This saw a reduction this year with mass brands’ market share dropping to 68% of sales this year as compared to premium brands. While the sale of mass brands has increased to 1.47X YoY, the premium brands’ sales increased to 1.85X this summer.

Similarly for Body Lotion, while mass brands had a market share of 51% in the summer of last year, it has gone down to 47% in the summer months this year. While we saw minor degrowth in mass brands with the sale being 0.93X YoY, the premium segment grew to 1.15 times.