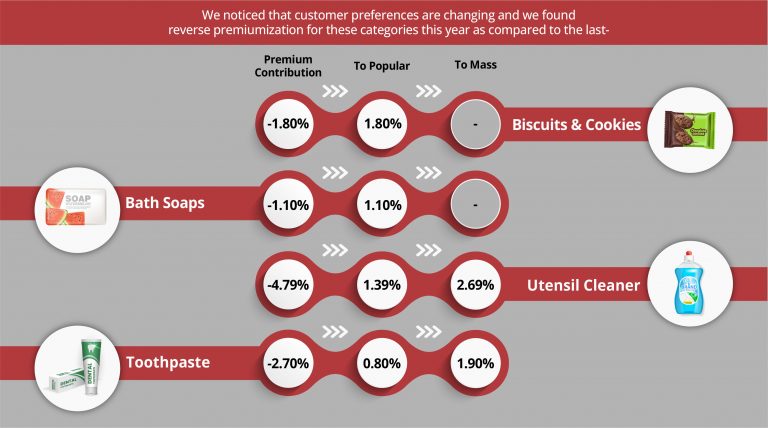

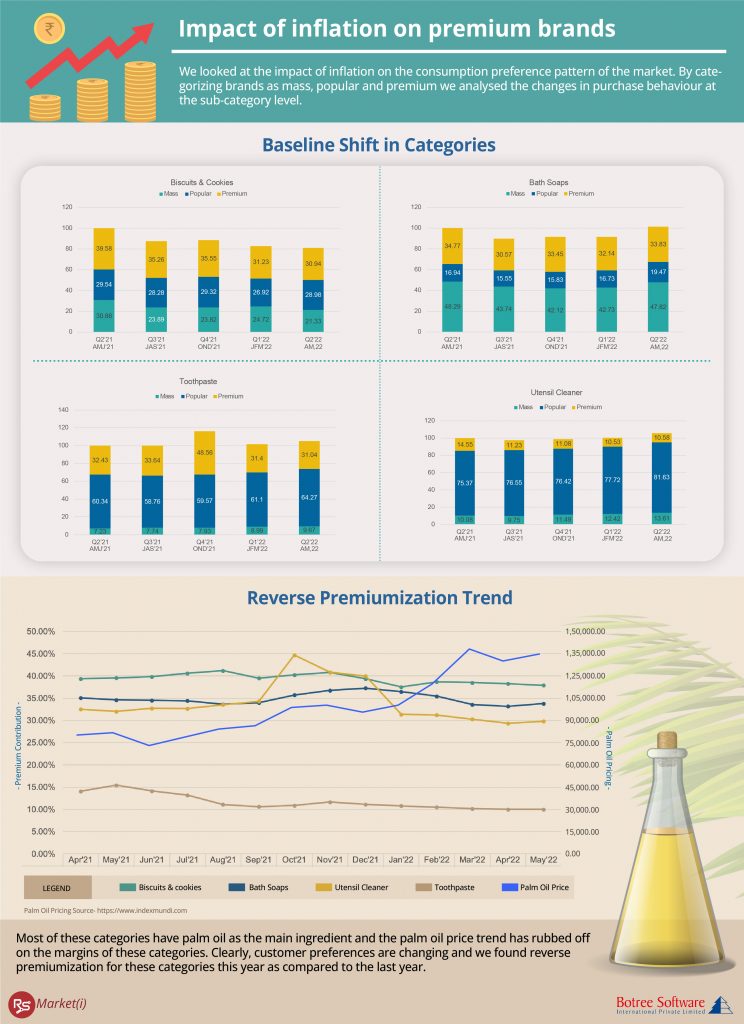

We looked at the impact of inflation on the consumption preference pattern of the market. We observed the change in purchase behaviour by categorizing brands as mass, popular and premium. While de-growth in premium categories indicates a switch to popular and mass, de-growth of mass brands is an indicator that category is not essential.

We looked at category performance to see how they have performed Y-o-Y. While biscuits as a category shrunk, others grew.

Most of these categories have palm oil as the main ingredient and the palm oil price trend has rubbed off on the margins of these categories. Apart from biscuits and cookies, these categories have experienced growth which means the popular and mass brands are not only eating into premium category share, but they are also seeing organic growth and thus the slow shift in consumer preferences is here to stay.

For the declining biscuits and cookies category, which has a similar contribution from mass, popular and premium, the Y-o-Y change in consumption of premium categories declined by 45bps. While the category contribution itself shrunk by 83bps, the consumption of popular brands remained stable indicating a switch from premium to popular.

We noticed that customer preferences are changing and we found reverse premiumization for these categories this year as compared to the last –