Indian Retail is dominated by traditional retailers with close to 12.8 million stores. The extreme fragmentation has made data collation hard and store level intelligence the holy grail of Indian commerce.

A better understanding of the stores not only helps the salesperson to anticipate and fulfill the demand of the store, but at a strategic level, the store footfalls, the locality, and geo level information help in better forecasting, inventory and supply chain management and successful product launches.

Store intelligence has multiple layers to it. The rise of AI/ML has allowed us to look at the store holistically with lots of variables to identify the store’s potential. Catalog level intelligence helps us know the profile of the store and the shopper composition. Pricing information helps in knowing other nuances of the locality and the shoppers at the store. And when it comes to the customer intelligence from tertiary sales data, there is just no end to the creativity of modern-day data scientists to dig insights to help companies build a better proposition for stores and shoppers.

While the customer intelligence to drive market share, loyalty, and inventory management is top of mind of companies, the importance of store intelligence in sales force automation and distribution management is often not considered when designing the promo programs or choosing the products to push.

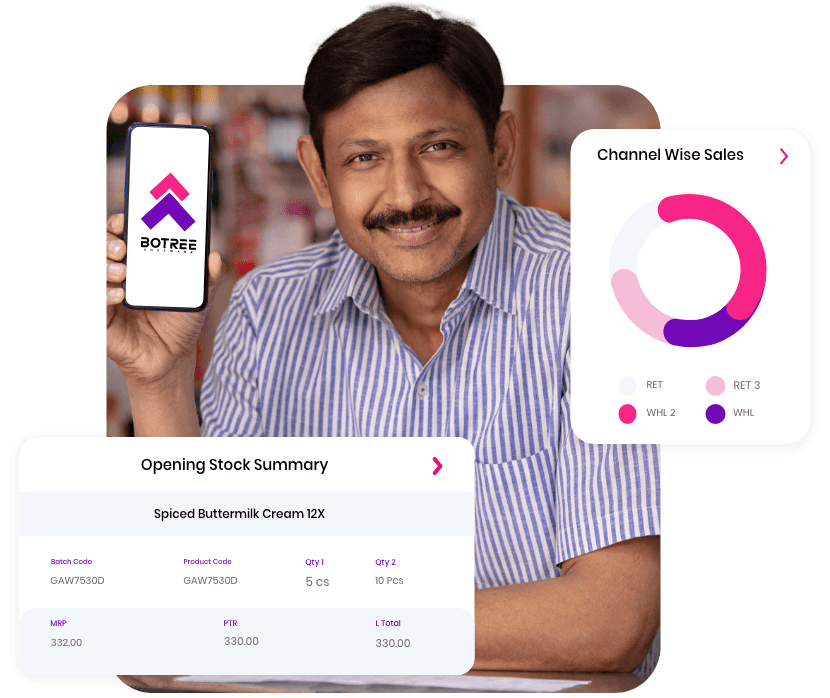

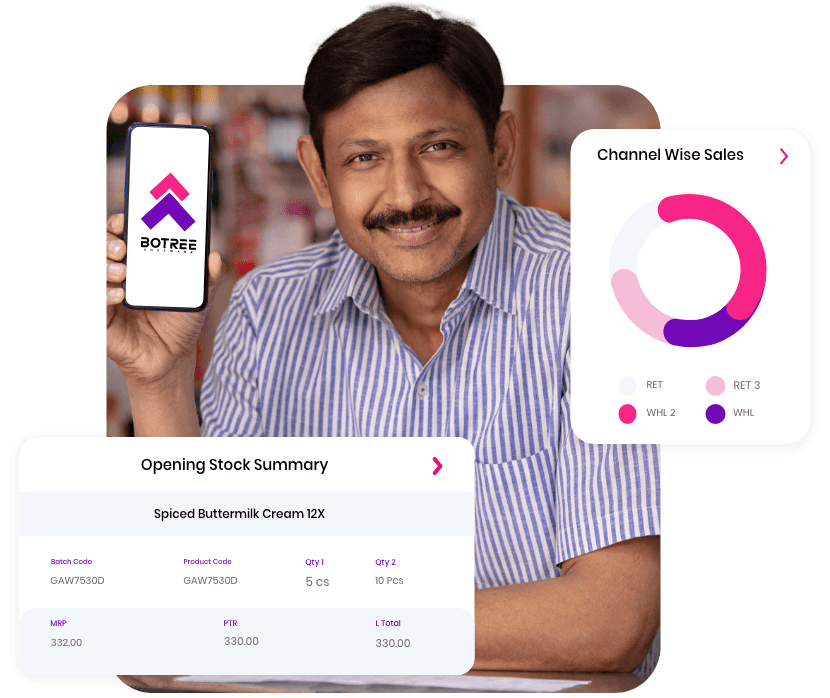

For example, one of our clients uses tertiary offtake data to build store-specific strategies where suggested order quantity and must-sell SKUs list are generated at a store level. These SOQs and ‘must sell’ SKUs are integrated via APIs into the Botree SFA, so the salesperson gets assistance when he/she is servicing the store to not only boost the market share but to improve the product assortment as well.

However, if the distributor management system (DMS) is not talking to the analytics engine and SFA is not connected to the insights, then even with all the data, the execution will remain super hard.

While the quest for store-level intelligence is at the top of all company’s initiatives, it needs a combination of process and technology excellence to reach there. We may have come a long way from the time when the biggest challenge was to identify the store uniquely. With the surge in digitization and KYCs solving the issue partly, companies still grapple with issues to correctly categorize and to classify the stores. Even if the data curated is accurate, most companies see only the part of the store that is visible to them, and they can’t see the full picture.

Therefore, companies with multiple product lines push their sales for assortment selling metrics because otherwise, they would never know the true potential of the store.

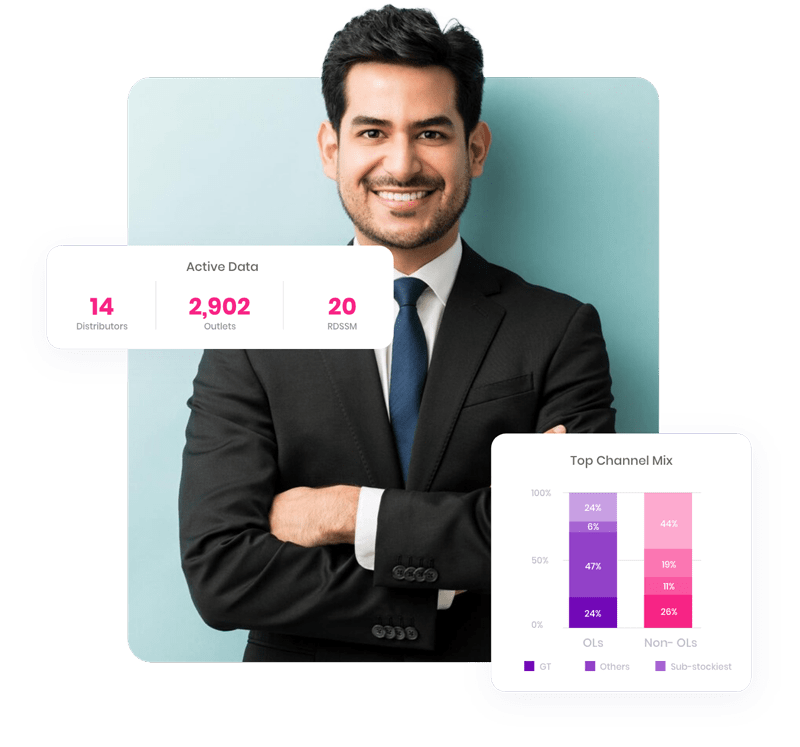

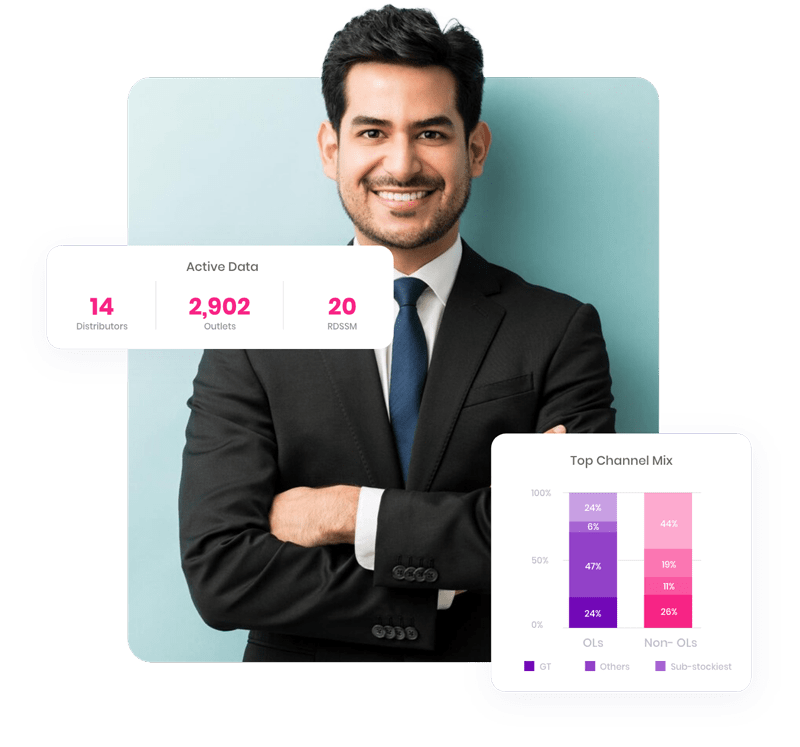

Botree Software is probably the only company who has a

unique view of the store from multiple lenses and is uniquely poised to unlock

the store’s potential by truly knowing the store.

Connect with us to know more about how we are managing the stores

for our DMS and SFA customers and how our RSMarket(i) platform allows all

stakeholders to participate in the connected retail universe in real-time by

consolidating data from Transaction (off-take), Loyalty (shopper/CRM), and uses

it in tandem with data streams such as internal sales data, social networking

data sets to generate insights for the business across the shopper pyramid.